CRED: UPI, Bills, Credit Cards app for iPhone and iPad

CRED is a members-only app for all payment experiences.

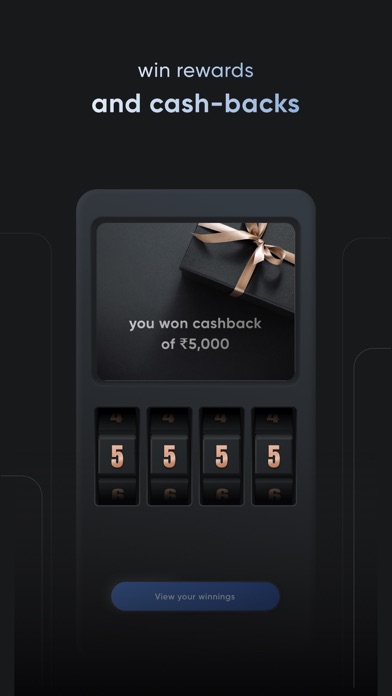

Trusted by over 25 million+ creditworthy members, CRED rewards you for the payments & good financial decisions you make.

What payments can you make on CRED?

→ Pay credit card bills: Check credit information & manage credit cards without downloading multiple credit card apps.

→ Online payments: Pay via UPI or credit card when you checkout from brands like Swiggy & Myntra via CRED pay.

→ Send money to anyone: Use CRED UPI to pay phone numbers or UPI IDs.

→ Transfer money to bank: Send rent or education fees from your credit card.

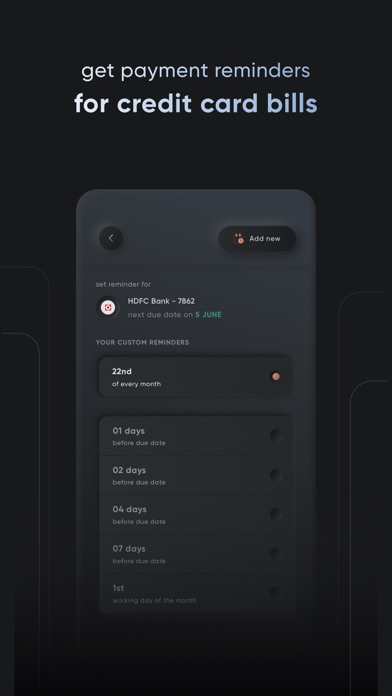

→ Pay bills: Pay utility bills, credit card bills, DTH bills, mobile recharge, house/office rent, and more. Get payment reminders so you never miss a due.

What else can you do with a CRED membership?

→ Manage credit cards: Add and manage multiple credit cards on CRED

→ Check bank balance & credit score: Track your credit score report

→ View hidden charges: Automatically detect hidden charges on your credit cards & get alerted on duplicate transactions

→ Get smart statements: Keep track of how you use your credit card with smart statements

→ Earn rewards: Unlock exclusive perks & privileges, just for being a CRED member

Upgrade your lifestyle with CRED:

→ Curated shopping experience on CRED store

→ Curated stays & holiday packages on CRED escapes at special prices

→ Manage vehicles’ insurance, FASTag, PUCC, and more on CRED garage

→ Get pre-approved personal loans on CRED cash

Bills you can pay using credit card or UPI:

Rent: Pay your house rent, maintenance, office rental, security deposit, brokerage, etc.

Education: College fees, school fees, tuition fees, etc.

Telecom Bills: Recharge your Airtel, Vodafone, Vi, Jio, Tata Sky, DishTV, prepaid or postpaid connections, broadband, landline, cable TV, etc.

Utility Bills: Electricity bills, LPG cylinder, piped gas, water bill, municipal tax, etc.

Other Bills: Fastag recharge, insurance premium, loan repayment, etc.

How to be a CRED member?

→ CRED is built to reward creditworthy individuals. To become a CRED member, you need a credit score of 750+.

→ The process is simple → Download CRED → Fill your name, mobile number & email ID → Get a free credit score report

→ If your credit score is 750+, you will get a prompt to verify credit card details

→ Enjoy the privileges of being a CRED member

What is Credit Score?

→ Check your credit score on CRED, no matter what credit card you have

→ Each credit score has a different scale

→ A score of 700+ on CRIF & Experian is considered to be good

→ A higher credit score is an indicator of good financial behavior

Credit scores shown on CRED:

There are 4 credit bureaus in India - Experian, Equifax, CRIF & CIBIL. CRED can showcase your CRIF, Experian & Equifax credit scores and helps track these credit scores individually.

Can CRED help in improving credit score?

With CRED make bill payments on time which will help improve your credit score over time.

Credit Cards supported on CRED:

HDFC Bank, SBI, Axis Bank, ICICI Bank, RBL Bank, Kotak Mahindra Bank, IndusInd Bank, IDFC First Bank, YES Bank, Bank of Baroda, AU SMALL FINANCE BANK, Federal Bank, Citi Bank, Standard Chartered Bank, SBM BANK INDIA LIMITED, DBS Bank, South Indian Bank, AMEX, HSBC Bank, all VISA, Mastercard, Rupay, Diners club, AMEX, Discover credit cards.

Lending partners on CRED:

IDFC First Bank Limited, Crédit Saison - Kisetsu Saison Finance (India) Private Limited, Liquiloans - NDX P2P Private Limited, Vivriti Capital Pvt Ltd, DBS Bank India Limited, Newtap Finance Pvt. Ltd.

Contact us

Have things on your mind? Don’t keep it to yourself. Contact us at [email protected].

Pay anyone via UPI, clear all your bills, improve your credit score & earn rewards with CRED. Download Now.